SDN fabrics make interconnection easier than ever, but which one is best for you depends on many things.

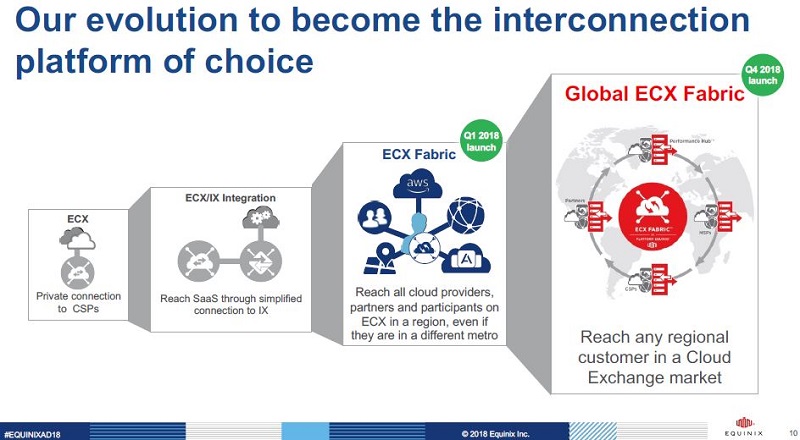

If you’re an Equinix customer and want to use its software-defined network platform to connect to partners, service providers, or your own infrastructure in other Equinix data centers, the company says you can now do that across metros. The platform, launched in 2017, previously only supported connectivity within metros. In other words, you could use it to spin up virtual links between two data centers in Silicon Valley, for example, but not between Silicon Valley and Los Angeles, or Los Angeles and Sydney. The two latter examples are now real options, as are many others, Equinix announced Tuesday.

The new inter-region connectivity is available in the “vast majority” of Equinix data centers across 36 metros, Bill Long, the company’s VP of interconnection services, told Data Center Knowledge. It doesn’t cover all Equinix data centers, but it’s in the markets responsible for most of its revenue, and Equinix plans to eventually expand it to the rest of its footprint. “We’re working our way down the list,” Long said.

While latency-sensitive use cases like database calls aren’t a good fit for such inter-region connectivity, it does work for things like accessing cloud-based applications, “where latency isn’t a huge issue,” Long explained. Those would be services like Salesforce, Gmail, or Office 365.

The SDN platform only supports connectivity inside and between Equinix data centers. The company’s argument – a fair one, since it is the world’s largest interconnection player – is that most connections customers will want to make are inside its 200 or so data centers anyway. If that’s true for you, you’ll probably find that the ECX Fabric (ECX stands for Equinix Cloud Exchange) does the trick.

But, if you want to use an SDN fabric to link outside the Equinix ecosystem – and it’s a vast universe outside, despite Equinix’s best efforts – you’ll probably turn to a platform like Megaport, whose fabric supports Equinix facilities plus the facilities of 81 other data center operators around the world. You may also come across Megaport's smaller competitors, such as PacketFabric or PCCW Global’s ConsoleConnect. (Hong Kong-based PCCW bought the intellectual property of Console Connect Inc. when it was sold for parts in 2017.)

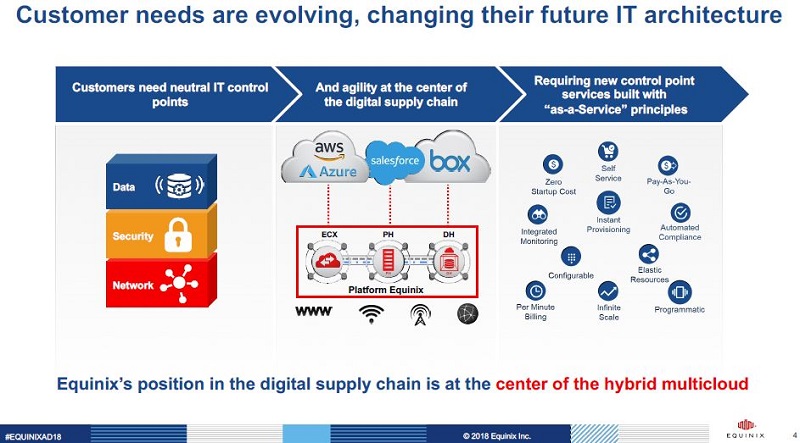

All this SDN fabric stuff is important today mostly because of hybrid cloud, which appears to be the enterprise architecture of choice for at least the foreseeable future. And helping companies stitch together their hybrid infrastructure is becoming a big business.

Equinix has for a long time been the leading data center colocation provider in interconnection. It became so by chasing customers whose networks are important for others to connect to. The more such networks you have in your data center, the more valuable and “sticky” your data center becomes for even more networks. The strategy paid off, creating a wide moat for Equinix in the form of a critical mass of networks that make many of its data centers essential to global connectivity. As hybrid cloud took hold, being the places where most networks interconnect also gave Equinix data centers a natural advantage in becoming the places where companies link their networks to their cloud providers’ infrastructure via so-called "cloud on-ramps."

But the advent of SDN platforms like Megaport’s has made physical presence on a single provider’s campus crucial in fewer cases. If you want to connect to a service provider inside a particular Equinix data center, you no longer have to lease colocation space and buy a physical cross-connect from Equinix, or pay a carrier to do all that for you. You can be a CyrusOne customer, for example, and use Megaport to make a virtual connection you need in a matter of minutes. Ultimately, your application requirements will dictate whether a dedicated physical connection is a must (and in many cases it will be), but the point is, a virtual connection from a remote location is now an option – when latency permits.

SDN platforms make connections to public cloud platforms faster and easier. The part that takes the longest is the customer’s data center provider setting up a physical cross-connect between the customer’s network and the SDN fabric. Once that’s ready, “we’ve had customers turn up live capacity to AWS, GCP, Azure, etc. in less than five minutes,” Eric Troyer, Megaport’s chief marketing officer with a decade-long Equinix tenure in his past, told us via email.

It’s worth noting here that one of Megaport’s investors is Digital Realty Trust, Equinix’s biggest competitor. Megaport’s fabric underpins Digital’s SDN interconnection platform called Digital Service Exchange.

Long-Distance Cloud?

Equinix executives’ standard answer to the question about SDN platforms (including its own) eating into its bread-and-butter traditional interconnection revenue has been that a virtual connection is usually only a starting point for a customer. As their bandwidth needs on a single connection grow, they eventually graduate to a dedicated physical cross-connect, Long said. Some major use cases for the new inter-regional connectivity, however, should see customers use virtual links on a more permanent basis.

One such use case – and Long expects it to be one of the biggest ones – is connecting to a cloud on-ramp from a region where the cloud provider doesn’t have a physical point of presence, he said. These connections link to the nearest node for each provider’s private connectivity service, such as AWS Direct Connect or Azure ExpressRoute.

Supply chain management company Havi, for example, uses ECX to connect a data center in Chicago to Oracle’s cloud infrastructure in Ashburn, Virginia, according to Equinix; Easybook, a travel-booking platform that serves Southeast Asia, uses ECX to connect to Microsoft Azure from markets that don’t have Azure data centers.

Another big use case, according to Long, is provisioning a virtual link temporarily while waiting for your network provider to provision a dedicated physical circuit.

For many users, a virtual link to Direct Connect or ExpressRoute will be the only way to connect to the cloud without using the public internet. A single virtual connection on both ECX and Megaport tops out at 10 Gigabits per second. If you need more bandwidth on a single link, you’ll need a dedicated connection, but those aren’t easy to get for small companies. Only big companies, with multiple entry points to the cloud provider’s network, can get dedicated links.

And there’s been no shortage of companies using the virtual option. The amount of virtual links into Azure’s ExpressRoute, for example, has skyrocketed over the last two years, a person familiar with the matter who wished to remain anonymous told us. The lion’s share of those links have been through ECX, the person said – which supports Equinix’s thesis that its on-campus ecosystem moat is wide and deep enough to guard against the threat of competing inter-region SDN fabrics.

“Several hundred” Equinix customers use ECX Fabric today, with more than 1,000 connections live, Long said. More than 10, including the three examples above, use it for inter-region connectivity.

Not Competing with Carriers… Mostly

Equinix has maintained that ECX does not compete with network carriers – some of its most valuable strategic customers. These service providers make up more than one-third of the fabric’s users, using it to expand the amount of connectivity options they can offer their own customers, according to Long.

In some “corner cases” ECX does replace carriers, however. One example is the Brazilian news agency Agência Estado, which uses ECX to interconnect its infrastructure in São Paulo and New York. An Equinix slide deck quotes the agency’s IT director saying the connection provides 20 percent lower latency than its “dedicated telecom links.”

So, What Does It Cost?

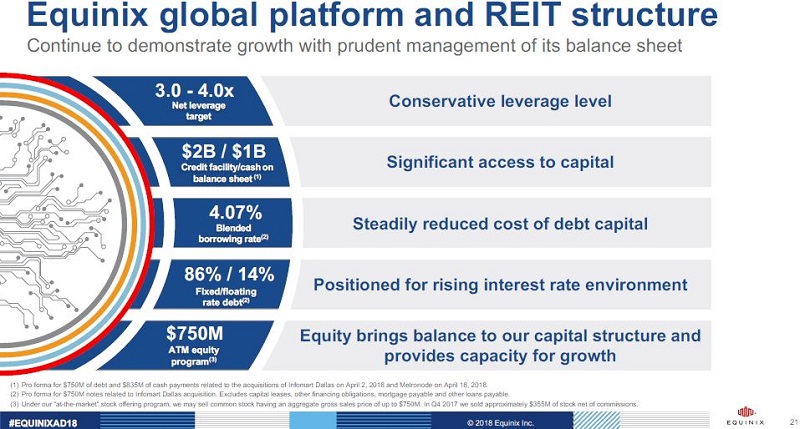

This has been the hardest question to get Equinix to answer. The company has been reluctant to share much detail about what ECX costs publicly; no pricing information is available on its website, and it took a lot of back-and-forth with Equinix spokespeople to get the three price examples below. (You’ll probably have an easier time if you’re a customer.)

Customers can choose from 1 Gigabit per second to 10Gbps for their ECX links. (Megaport provides the same bandwidth choices.) If you need more than 10Gbps on a connection, a physical cross-connect will be more cost-effective, Long said.

Your overall cost will depend on bandwidth, distance, and the amount of time you’re using a virtual connection for. Equinix quotes a monthly rate, while your bill will be prorated on a per-day usage basis. A 1G link between London and New York costs $1,350 per month, for example, while a 500Mbps one on the same route will cost $670, a company spokesperson told us via email. High-bandwidth virtual connections between regions can run north of $10,000 per month, she said. You will also have to pay Equinix for a physical cross-connect and a monthly port fee to use ECX. (Your list of expenses to use Megaport will contain these line items as well.)

Most connections between Equinix customers occur within its campuses, which according to Long gives ECX a “fundamental cost advantage” over competing SDN platforms. In other words, if you’re on a network-dense Equinix campus, theoretically, you’re likely to find all the networks you need to connect to right there and won’t have to pay the high cost of connecting from elsewhere over a long distance.

Within a single Equinix campus, considering the connectivity costs alone, it’s not hard to imagine that Equinix is at least able to provide virtual connectivity at a lower cost than its SDN fabric competitors can. Those competitors pay Equinix for colocation space and the cross-connects necessary to reach all the networks they need to reach inside its data centers.

As Megaport’s Troyer pointed out, customers must consider the cost of being on an Equinix campus when weighing the cost of using ECX. It’s some of the most premium colocation space on the planet, and some companies may find it more cost-effective to be in a cheaper colo while using a service like Megaport to remotely connect to a cloud on-ramp inside an Equinix data center.

Megaport’s Elastic Pricing

None of these cost considerations really matter if you need virtual links to places than aren’t Equinix data centers. Several customers use Megaport to connect Equinix and other providers’ data centers, Megaport’s Troyer said. One Fortune 500 company uses Megaport to connect seven Equinix data centers as its IT backbone, but also CyrusOne, QTS, and Data Center 220 sites, he said.

Megaport has a more flexible billing model, charging for use on a minute-by-minute basis (versus Equinix’s daily minimum increment). It can also scale bandwidth on a connection up and down based on demand, adjusting the price accordingly.

According to Megaport’s online price estimate tool, connectivity on a 1G link between London and New York will cost about $528 per month if you use it for 28 days straight (bandwidth used will only vary between weekdays and weekends). But if you use the dynamic-bandwidth option, your bill for the month could be as little as $292 on the same route. (These are only hypothetical scenarios; your cost will depend on actual use.) Megaport charges a flat monthly fee for virtual connections within a single metro: $100 up to 1Gbps and $200 up to 10Gbps.

To use Megaport you also have to pay $350 per month for a 1G port or $500 for a 10G port on top of the data charges above, plus whatever your data center provider charges for a cross-connect to Megaport’s platform. If you’re using it as your own network backbone instead of an on-ramp into one of the service providers Megaport is integrated with (for example, to connect two colocation sites that host your equipment) you’ll pay cross-connect and port fees on both ends of a connection.

In the End, It All Depends

As with most network architecture decisions companies make, every option has its own set of tradeoffs to consider. If you’re already an Equinix customer, can reach all the networks you need to reach from one or more Equinix campuses you’re in, and don’t need more than 10G per single connection, it’s hard to see why you would choose Megaport or another SDN fabric over ECX (assuming that ECX is at least competitive with the others on pricing).

It gets a bit more complicated if you can’t tick all those boxes. You have to take into consideration factors like colocation costs, distances, application use cases, workload latency requirements, and bandwidth consumption trends, among others.

SDN fabrics have made connecting to a wide variety of networks faster and easier than ever. But at their core, network connections are physical, and some physical limitations (like the speed with which light travels along a thin glass tube) have so far been too difficult to solve with software.