While data center providers in Houston weathered Hurricane Harvey and subsequent flooding without any publicly disclosed outages, Hurricane Irma, a Category 5 storm headed for Florida, will be another stress test for the internet and private network infrastructure in the South. And because of Florida’s strategic importance to network connectivity, the stakes will be higher when Irma makes landfall in the Sunshine State, which the National Weather Service says will happen Sunday.

If some buildings in Irma’s path lose power, the effects on connectivity could ripple well beyond the region that immediately surrounds it. One particular building is especially critical.

NAP of the Americas, the Miami data center and carrier hub, is the biggest network gateway between the US and Latin America, and companies in the US that rely on it alone to serve customers south of the border would not be able to reach those customers if it goes offline. In addition to being a cross-continental gateway, Miami, and especially the NAP, serves as the primary interconnection hub for most Latin American networks.

“Miami appears to be the only strategically critical communications node in the hurricane’s path,” Jon Hjembo, senior analyst at the telecommunications market research firm TeleGeography, said. “From a network perspective, what’s so worrisome about Irma targeting Miami is that, not only does it present a risk to network infrastructure in the southeast coastal region, but it threatens communications across Latin America.”

Submarine cables move Latin American traffic up to Miami, he explained, and from there traffic gets distributed back south to its final destinations in Latin American markets. Some cables that land in South America, such as the new Seabras-1 system, land in the New York-New Jersey area on the US side, “but for most LatAm networks, Miami is the place to peer with one another and get access to major content providers.”

According to PeeringDB, content and cloud service providers that host network nodes in NAP of the Americas include Amazon, Apple, Dropbox, Facebook, Google, LinkedIn, Microsoft, Riot Games, IBM’s SoftLayer, Twitter, and Tencent, among others.

![]()

Equinix's NAP of the Americas in Miami

Many companies that exchange traffic in Miami have alternate routes for their Latin American traffic, and many have network nodes in the Latin American markets they serve, so an outage at the NAP wouldn’t mean a complete cross-border network blackout, but not everybody has built such resiliency into their network infrastructure.

Nitin Rao, head of infrastructure strategy at CloudFlare, which speeds up web content delivery for companies and helps them withstand cyberattacks, said companies that have network nodes in multiple facilities inside and outside the Miami metro would most likely not experience major performance degradation had NAP of the Americas or other interconnection facilities in Irma’s path gone down.

“We can’t speak for every other network,” he said, but “a number of the larger networks will have a lot of redundancy.”

Still, “the NAP is critical enough that any impact to the NAP would result in a drop in traffic,” Rao added. “There isn’t an obvious number-two.”

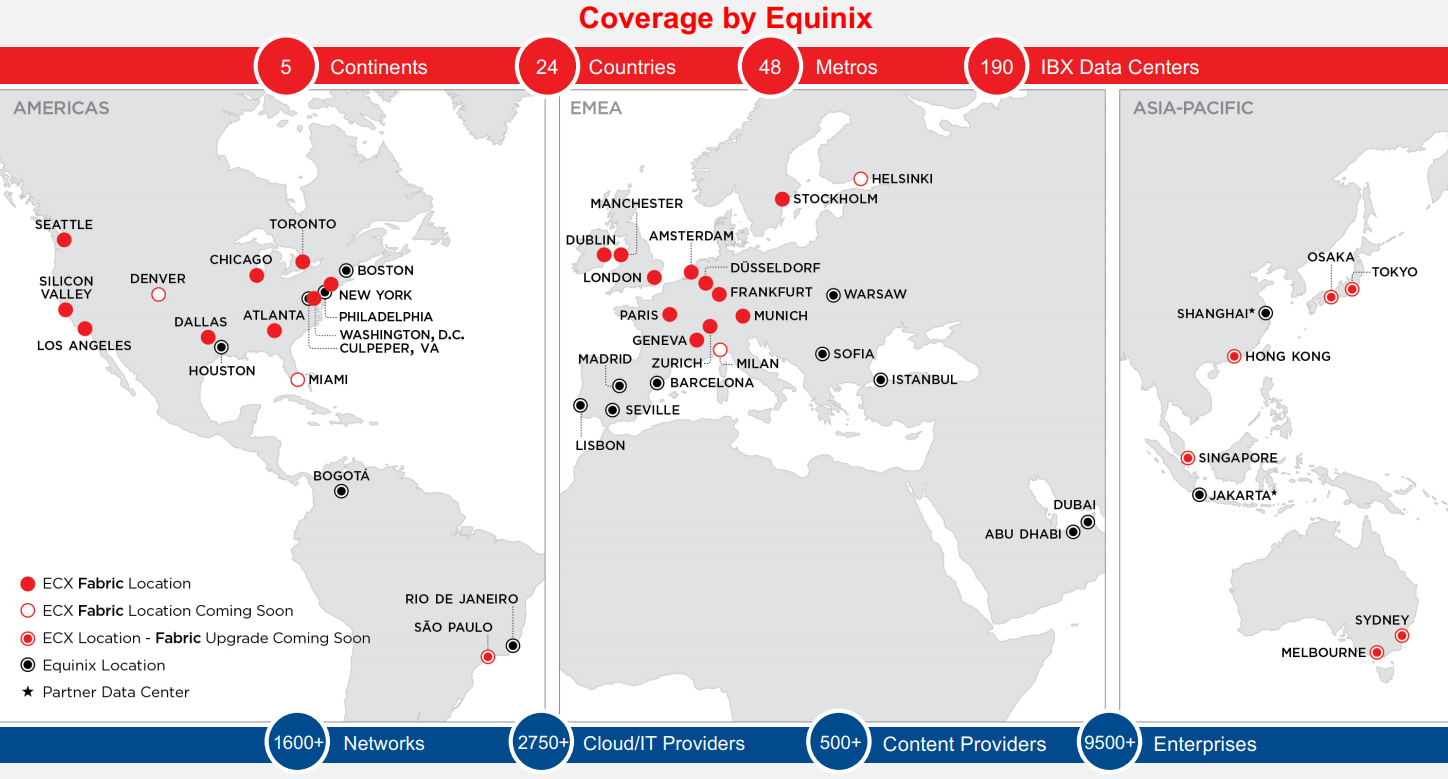

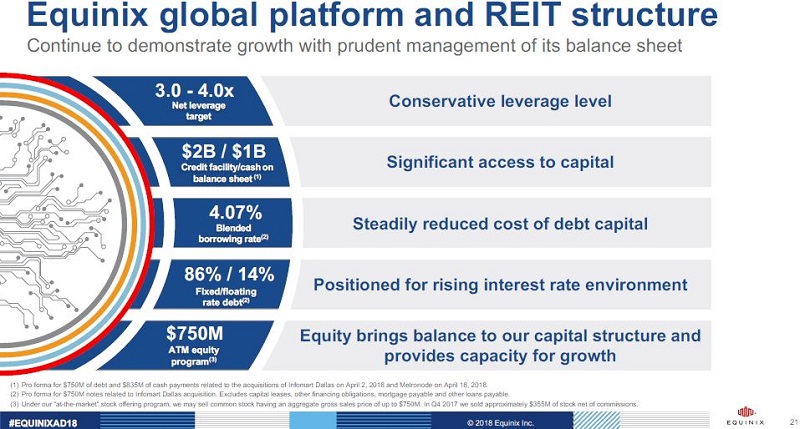

NAP of the Americas is owned and operated by Equinix, the Redwood City, California-based data center and interconnection services provider who acquired it as part of a large data center portfolio from Verizon in a $3.6 billion deal that closed earlier this year. Because of its strategic importance to connectivity in the Americas, it is the crown jewel in the former Verizon data center portfolio.

The building is designed to withstand Category 5 hurricane winds and stands 32 feet above sea level, according to Equinix’s website. The company has three data centers in the Miami area and an office in Tampa, about 300 miles to the north.

In a statement, an Equinix spokesperson said the company is following its protocol for “weather-related events” this week, as it prepares for Irma. “As with Harvey, the data center staff will be prepared to spend an extended period of time in the buildings throughout the duration of the storm to ensure operational continuity. We have prepared with food, water, cots, etc.”

The company planned to close its office in Tampa mid-day on Thursday to allow employees and their families prepare for the storm.

Many of the networks exchanging traffic at the NAP of the Americas Internet Exchange, or NOTA, also use the Florida Internet Exchange, or FL-IX, for redundancy. FL-IX is distributed across eight data centers, which include NAP of the Americas and other buildings in Miami, as well as facilities in Boca Raton and Ft. Lauderdale.

If NOTA went down, their traffic would be automatically rerouted to FL-IX, and, depending on the service provider, to one or several other major interconnection cities in the South, such as Dallas or Atlanta, whichever location a particular provider has its closest network node in, Rao said.

Irma causing an outage at the NAP of the Americas is far from a given. Besides being located and designed with natural disasters in mind, such facilities have layers upon layers of infrastructure redundancy, backup generators, and on-site fuel supplies.

The effectiveness of all these precautions was demonstrated in the aftermath of Harvey’s landfall in Houston, but things do go wrong every so often, and it’s always wise to architect a network in a way that doesn’t incapacitate it if one site goes down.